Kota Damansara 2 October 2024 – This year’s APOS – Asia’s Premier Event For The Media, Telecoms & Entertainment Industry, was held at Ayana Resort, Bali, Indonesia from 24-26 September. IPSB Technology, represented by our Managing Director, Datuk Nasir Baki and Lead, Marketing & Monetization, Khairul Anwar attended APOS to gain insights into the latest developments shaping the Asian entertainment landscape.

ABOUT APOS

APOS, founded by Media Partners Asia in 2010, is the leading annual gathering for local and global industry leaders in the media, telecoms, and entertainment sectors across Asia. The event serves as a platform for networking, deal-making, and thought leadership. APOS addresses the latest trends, challenges, and opportunities shaping the industry.

With a focus on innovation, technology, and emerging consumer behaviors, APOS brings together key players from across the region to discuss the future of entertainment, including streaming, content creation, distribution, and monetization.

Media Leaders Converge at APOS

Key players in the Asian entertainment industry, including global giants Netflix, Warner Bros Discovery, Amazon, YouTube, among others, gathered at APOS for two days of networking and potential deal-making.

Malaysia’s media landscape was well-represented at APOS, with representatives from Radio Televisyen Malaysia, Astro, and Telekom Malaysia among those attending the event.

APOS 2024 agenda cover a variety of topics related to the media, technology, and business industries :

- Media and Entertainment: Monetization of news, future of video aggregation, content creation, and storytelling.

- Technology and Infrastructure: Future of connectivity, digital infrastructure, and payment systems.

- Business and Economics: Building global leaders, digital infrastructure investment, and value creation.

These topics collectively provide a comprehensive overview of the key trends, challenges, and opportunities shaping the media, technology, and business landscape.

Key Takeaways from Apos, Bali 2024

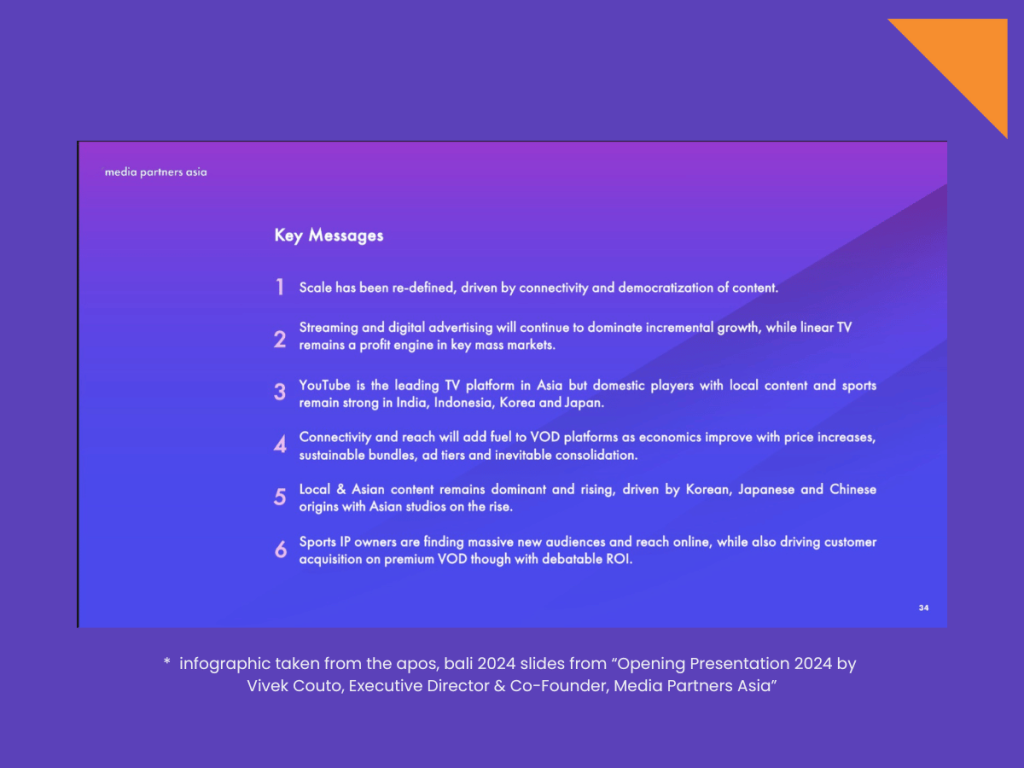

- Premium AVOD (advertising-based video on demand) and UGC (user-generated content) shows an increase from 2020 to 2024 and expected to increase while TV advertising revenue is expected to decrease by 2029. AVOD offers users free access to on-demand content, in exchange for watching ads. This generates ad revenue, which offsets production and hosting costs. UGC harnesses real users’ POVs and experiences to engage and persuade prospects, through social media platforms. UGC are original material used in campaigns, such as images, videos, reviews, and testimonials. UGCs are created by actual product users instead of marketing teams.

* “Over the next five years, we project the industry will add an incremental $9.6 billion in ad dollars,” Couto added, “but TV will decline by $5 billion, UGC social will gain $10.7 billion and premium AVOD will add $4 billion.”

* quote taken from https://www.hollywoodreporter.com/business/business-news/apos-2024-tv-trends-and-market-opportunities-1236011484/

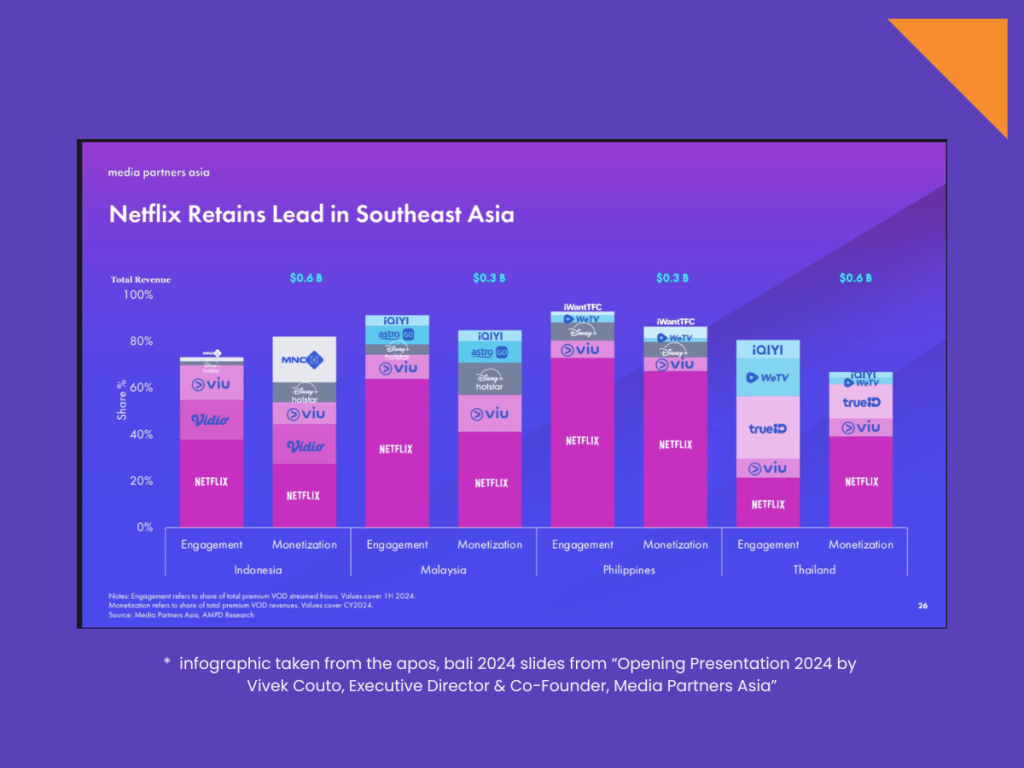

2. Netflix retains the lead in South-East Asia. Asia’s many local video platforms enjoy significant market share thanks to their robust content pipelines and local market fit. Couto said he believes the major streaming platforms are pushing to move users toward churn-resistant annual subscription plans . This were one of the factors behind the recent price increases for premium monthly subscriptions and the growing advertising loads on ad-supported tiers.

** “Platforms are building business strategies differently” around the various key partners of each market, Couto added. “Netflix, which began with a relentless direct-to-consumer focus, is now leaning more on partners for the next phase of growth,” while Disney is “going in the opposite direction with an increasing focus on D2C product.”

** quote taken from https://www.hollywoodreporter.com/business/business-news/apos-2024-tv-trends-and-market-opportunities-1236011484/

3. Sports content is leveraged by local streamers for subscriber acquisition. It’s a highly effective strategy for platforms seeking to attract and retain viewers. Asia’s many local video platforms thus enjoy significant market share, by acquiring sports content rights from Sports IP owners, both locally and internationally.

Summary – Local Media Entertainment: Navigating a Changing Landscape

Vivek Couto, managing partner of MPA, gave his analysis, highlighting the varying strategies employed by global video platforms in developed and developing markets within Asia. In developed markets, platforms focus on revenue from existing subscribers, while in developing markets, the emphasis is on expanding the user base. This reflects market differences in population demographics, economic conditions, and maturity. Local content drives engagement, but global players have a monetization advantage. The push for annual subscriptions aims to increase revenue and reduce churn.

The growth of Asian streaming markets is driven by increased internet connectivity and user-generated content. YouTube dominates with its main source of revenue is in advertising. Local platforms thrive in specific markets due to their focus on local content and sports. Asia’s expanding connectivity and economic factors will fuel the growth of video-on-demand services. This can be achieved through price adjustments, bundled offerings, and potential industry consolidation.

FUTURE OF BROADCASTING IN ASIA

The questioning projections highlight the challenges faced by local media entertainment in Asia. The dominance of global players, the potential impact of digital advertising, and the implications of partnership strategies are key areas of concern. The future of local media entertainment will depend on their ability to adapt to these changing dynamics and maintain their competitive edge.